Close

Creating value for institutional investors investing in the SADC region

Mangwana Capital is an investment advisory and private equity firm. We believe in Africa and its growth potential. We are focused on key sectors of the Southern African Development Community (SADC) economy: agriculture, resources, and energy with a focus on exports

/maeng-wah-nah/

Language: Shona

English Translation: Tomorrow

Mangwana Capital currently manages the Mangwana Opportunities Fund which invests in the primary sectors of Agriculture, Resources and Energy.

Mangwana Opportunities (“the Fund”) is an investor-owned, closed-end investment company. It is funded by over 35 Zimbabwean institutional investors investing in the economy’s primary sectors.

The Fund invests in companies that have access to unlimited global markets with products where there is a competitive advantage. It invests privately for premium returns in foreign currency generating businesses, import substitution businesses, and capital preservation and asset growth.

Investments in the Fund have been granted Prescribed Asset Status and Tax Exemption by the Ministry of Finance in Zimbabwe.

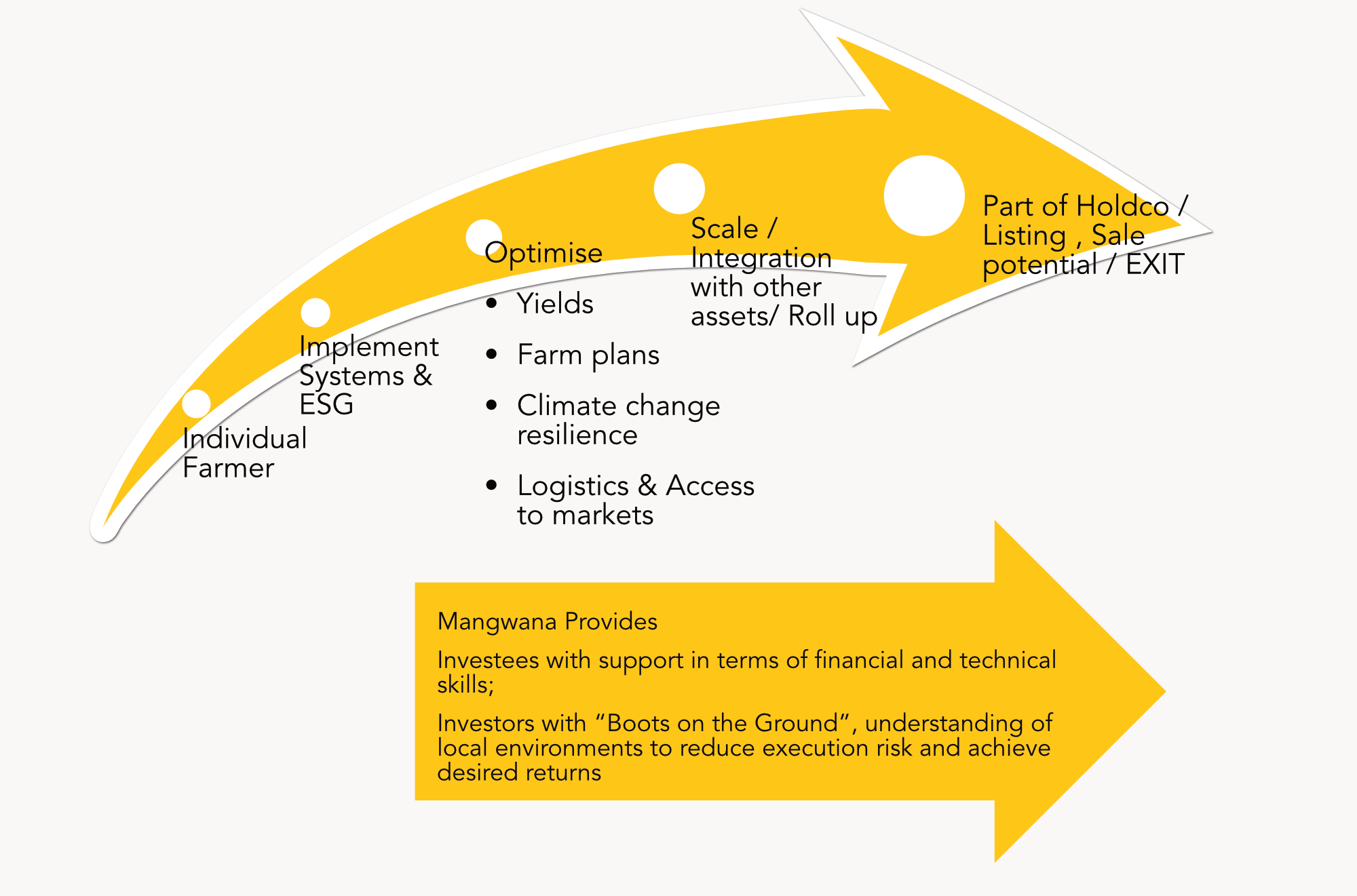

Mangwana is a hands-on partner that assists its portfolio companies to grow. Our principals take board seats, set strategy, oversee corporate governance best practice and work with managements to identify and implement business development goals.

The Fund’s objective is to achieve above average returns for its shareholders by originating and acquiring significant minority stakes in private companies which are poised for growth in target sectors.

We make investments in companies operating in the SADC region in the fields of natural resource exploration, mining and processing, horticulture and agriculture along the value chain, and energy exploration and generation.

The Fund pursues above-average net returns in United States Dollars terms, whilst ensuring capital protection through legal structuring, and managing the fund’s investments through to exit.

Realization of investments within the 10-year life of the fund (or longer if extended by investors) from listings, leveraged recapitalizations, portfolio sales, private placements or trade sales.

The Investment Strategy of the Fund is to deploy local capital, together with foreign investors and technical partners, into its portfolio companies which each have the potential for significant foreign currency earnings, capital preservation and asset growth.

Mangwana Capital is the investment manager of Mangwana Opportunities (Private) Limited.

The Fund pursues above-average net returns in United States Dollars terms, whilst ensuring capital protection through legal structuring, and managing the fund’s investments through to exit.

Realization of investments within the 10-year life of the fund (or longer if extended by investors) from listings, leveraged recapitalizations, portfolio sales, private placements or trade sales.

The Investment Strategy of the Fund is to deploy local capital, together with foreign investors and technical partners, into its portfolio companies which each have the potential for significant foreign currency earnings, capital preservation and asset growth.

Mangwana Capital is the investment manager of Mangwana Opportunities (Private) Limited.

The agriculture sector is of major social and economic importance in the SADC region, contributing significantly to GDP and export earnings. The regions’ population depends on agriculture for food , income and employment. Our approach to Agriculture and our key successes to date have been to:

On behalf of institutional investors, family offices, and farm owner/operators, we roll-up and support a diversified portfolio of sub Saharan farming assets with the goal of diversifying crop, climate and geographical risks.

We have successfully created value in difficult operating environments and constantly seek out investments along the agricultural value chain from farm to fork.

The agriculture sector is of major social and economic importance in the SADC region, contributing significantly to GDP and export earnings. The regions’ population depends on agriculture for food , income and employment. Our approach to Agriculture and our key successes to date have been to:

On behalf of institutional investors, family offices, and farm owner/operators, we roll-up and support a diversified portfolio of sub Saharan farming assets with the goal of diversifying crop, climate and geographical risks.

We have successfully created value in difficult operating environments and constantly seek out investments along the agricultural value chain from farm to fork.

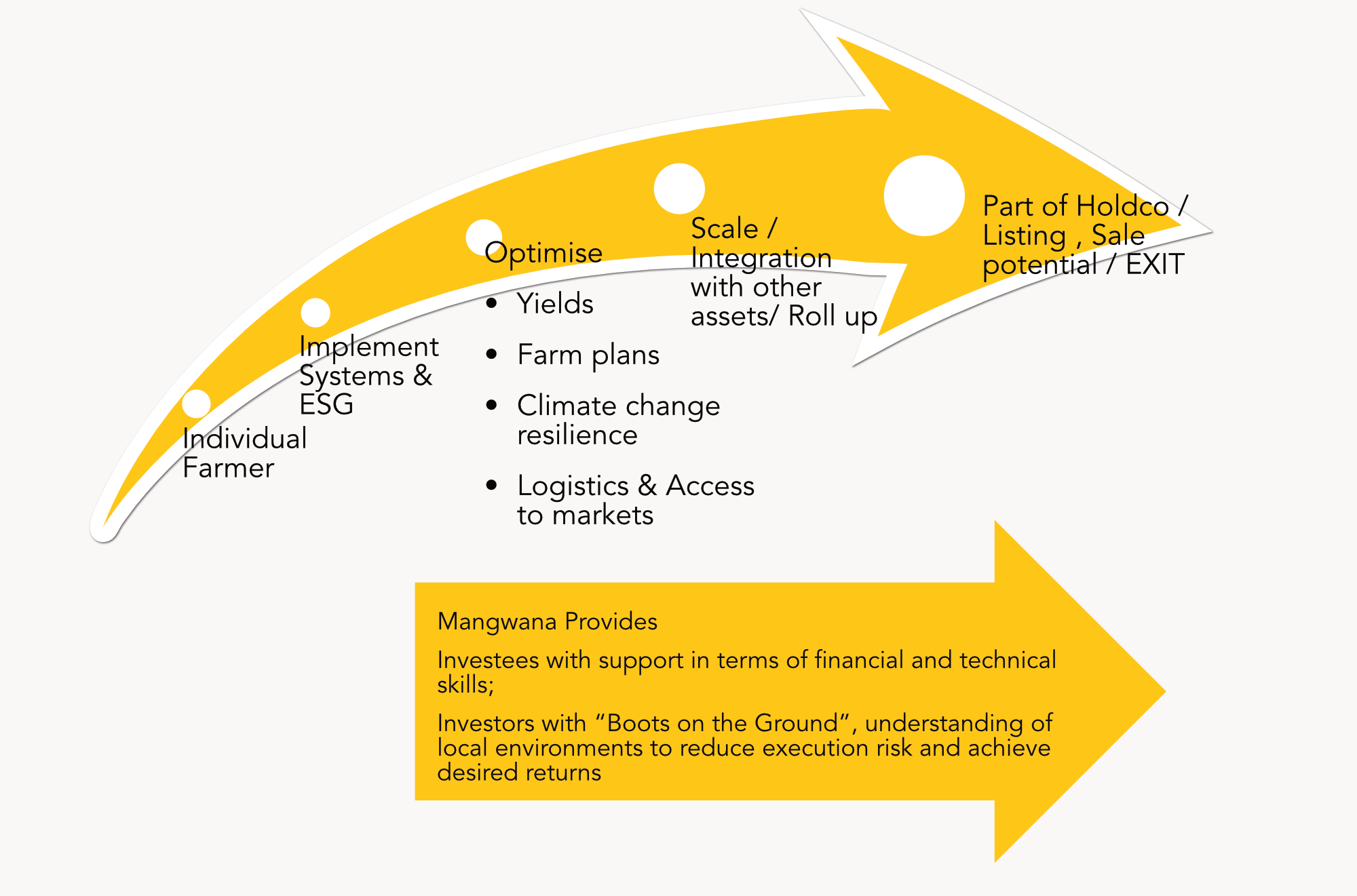

We believe there are a large number of unexplored mineral resources, especially in the battery minerals and oil and gas spaces. Following the approach as typified by this Value, Project Pyramid yields phenomenal returns.

We have made investments in entities with significant upside in nickel, vanadium, cobalt, and oil and gas which we are moving up the value chain.

Mangwana’s team combines over 100 years of operating business experience in Africa and includes skills in private equity, investment banking, corporate finance, business advisory and corporate strategy.

Mangwana follows the Environmental, Social & Corporate Governance (ESG) principles outlined by the UN.

Mangwana is committed to conducting outreach programs and continuously striving for high community involvement. We are committed to regenerative farming practices and environmentally sensitive development of natural resources. Mangwana’s governance protocols are of the highest standard.

Mangwana’s ESG focus:

Investing in gender equality provides some of the greatest positive returns toward the prosperity of a community.

Actions:

Sustained economic growth drives progress, creates decent jobs for all and improves living standards.

Actions:

Production and land use must utilise the natural resources in a way that has a long-term sustainable impact on the environment.

Actions:

All Mangwana Farms operate with a focus on Regenerative Farming.

Actions

Investing in gender equality provides some of the greatest positive returns toward the prosperity of a community.

Actions:

Sustained economic growth drives progress, creates decent jobs for all and improves living standards.

Actions:

Production and land use must utilise the natural resources in a way that has a long-term sustainable impact on the environment.

Actions:

All Mangwana Farms operate with a focus on Regenerative Farming.

Actions

Kevin Terry

Board Chairman

Former Managing Director for CABS before transferring to Kenya to assist in Old Mutual’s East African expansion drive. Former Group COO of Old Mutual Group. Kevin has vast experience in the banking and financial sector, with Old Mutual Zimbabwe for 34 years and CABS for 11 years.

Currently a Non-Executive Director at First Capital Bank Zimbabwe.

Noel Zvareva

Non-Executive Director

Highly experienced Chartered Insurance Professional accredited with the Insurance of South Africa (IISA) and the Chartered Insurance Institute of the United Kingdom (CII). Chartered Pension Analyst with 22 years of experience in Employee Benefits with a major focus in International Recruitment Funding Schemes, Life Assurance, and Business Development.

Currently the Head of Pensions at Minerva Aon Zimbabwe.C.urrently the Head of Pensions at Minerva Aon Zimbabwe

Kevin Terry

Board Chairman

Former Managing Director for CABS before transferring to Kenya to assist in Old Mutual’s East African expansion drive. Former Group COO of Old Mutual Group. Kevin has vast experience in the banking and financial sector, with Old Mutual Zimbabwe for 34 years and CABS for 11 years.

Currently a Non-Executive Director at First Capital Bank Zimbabwe.

Noel Zvareva

Non-Executive Director

Highly experienced Chartered Insurance Professional accredited with the Insurance of South Africa (IISA) and the Chartered Insurance Institute of the United Kingdom (CII). Chartered Pension Analyst with 22 yrs experience in Employee Benefits with a major focus in International Recruitment Funding Schemes, Life Assurance and Business Development.

Currently the Head of Pensions at Minerva Aon Zimbabwe.C.urrently the Head of Pensions at Minerva Aon Zimbabwe

Benedict Mbanga

Co-Founder and Managing Director B.Compt, FCCA, MBA

Managing Director of Mangwana from inception

Previously 21 years at Deloitte Africa

Regional CEO / Managing Partner of Deloitte Central Africa, Member

of Africa Executive for 6 years

Partner in Charge of Advisory for Deloitte Central Africa for 13 years,

Experience in Corporate Finance and Consulting

Steven Mupfurutsa

Executive Director – B.Acc (Hon) BSc. Accounting (Hon) CA (Z)

Corporate Finance Executive responsible for preparing the

investment case and deal structuring including performing due

diligence reviews as well as valuation of the target investment.

Finance and investments professional with over 20 years of

experience in finance, investment analysis and structuring,

International Financial Reporting Standards and Auditing.

Vongai Pfute

Financial Manager – B.Com (Hon) Finance

Finance professional with over 10 years of experience within the

banking, insurance, and private equity industry.

Previously Senior Accountant and Fund Administrator of Takura

Capital Partners.

Pension Fund Accountant of Minerva Risk Advisors.

Assistant Accountant of Royal Bank Zimbabwe

Nikita Mukorera

Senior Associate – BComm Banking, CFA Level II Candidate

Investments Analyst at Mangwana

Experienced Investments Analyst with a proven track record in the

investment and financial advisory sectors. Demonstrated expertise in

analyzing financial markets, institutions, investments, and corporate

finance transactions. Possesses a comprehensive understanding of

various financing alternatives and the skills necessary to navigate

complex financial landscapes. Skilled in financial modelling, due

diligence reviews and valuations.

Benedict Mbanga

Co-Founder and Managing Director – B.Compt, FCCA, MBA

Managing Director of Mangwana from inception

Previously 21 years at Deloitte Africa

Regional CEO / Managing Partner of Deloitte Central Africa, Member of Africa Executive for 6 years

Partner in Charge of Advisory for Deloitte Central Africa for 13 years,

Experience in Corporate Finance and Consulting

Steven Mupfurutsa

Executive Director – B.Acc (Hon) Bsc. Accounting (Hon) CA (Z)

Corporate Finance Executive responsible for preparing the investment case and deal structuring including performing due diligence reviews as well as valuation of the target investment.

Finance and investments professional with over 20 years’ experience in finance, investment analysis and structuring, International Financial Reporting Standards and Auditing.

Vongai Pfute

Financial Manager – B.Com (Hon) Finance

Finance professional with over 10 years’ experience within the banking, insurance, and private equity industry.

Previously Senior Accountant and Fund Administrator of Takura Capital Partners.

Pension Fund Accountant of Minerva Risk Advisors.

Assistant Accountant of Royal Bank Zimbabwe

Nikita Mukorera

Senior Associate – BComm Banking, CFA Level II Candidate

Investments Analyst at Mangwana

Experienced Investments Analyst with a proven track record in the investment and financial advisory sectors.

Demonstrated expertise in analyzing financial markets, institutions, investments, and corporate finance transactions.

Possesses a comprehensive understanding of various financing alternatives and the skills necessary to navigate complex financial landscapes. Skilled in financial modelling, due diligence reviews and valuations.

Welcome Mavingire

Chairman

Representing A Class Shareholders, Barclays Pension Fund, Standard Chartered Bank Pension Fund and Intellego Syndicate of Shareholders

CEO and Founder of Intellego investment advisors, advising several pension funds on investment strategies.

Welcome is a CFA Charter holder, equipped with 17 years of experience in the financial services sector in both Zimbabwe and Botswana.

Thomas Mutswiti

Member

Representing A Class Shareholder, First Mutual Life Assurance

Appointed as an Investment Committee member. Thomas has 13 years of experience in Financial Markets with two of these having been spent in the Banking Sector and 11 Years in the Asset Management Industry.

Current General Manager of First Mutual Wealth.

Welcome Mavingire

Chairman

Representing A Class Shareholders, Barclays Pension Fund, Standard Chartered Bank Pension Fund and Intellego Syndicate of Shareholders

CEO and Founder of Intellego investment advisors, advising a number of pension funds on investment strategies .

Welcome is a CFA Charter holder, equipped with 17 years’ experience in the financial services sector in both Zimbabwe and Botswana

Thomas Mutswiti

Member

Representing A Class Shareholder, First Mutual Life Assurance

Appointed as an Investment Committee member.

Thomas has 13 years experience in Financial Markets with two of these having been spent in Banking Sector and 11 Years in Asset Management Industry.

Current General Manager of First Mutual Wealth

Address: 12 Silwood Close, Chisipite, Harare, Zimbabwe

E-mail: info@mangwanacapital.com

Tel: +263 (242) 490264/498955

Balu Farm is a 4,500 hectare farm located just outside of Zimbabwe’s second largest city, Bulawayo. The farm is being converted into a 1000ha pecan plantation with additional revenues from the production of lucerne and beef cattle.

The company has planted 300 hectares of pecan orchards has installed 150 hectares of irrigation to produce lucerne.

With investment from Mangwana Opportunities, Balu plans to expand its pecan orchards under cultivation to 1,000 hectares over the next four years, and will become one of the largest pecan plantations in southern Africa.

Balu is a 50% shareholder in Southern Pecans- A joint venture with the community in Kezi, Matebeleland South, where they have planted further 150ha as pecans: https://vimeo.com/area46/review/483571789/34b4a8ccf0

Blue Agri operates through a corporate farming model with a centralized headquarters in Harare and 6 different farms in geographically diverse locations in Zambia and Zimbabwe. The business is divided into 4 separate divisions with each division specializing in a particular crop, name: Bananas, Avocado, Citrus, Stevia and Cut Flowers. Blue Agri provides a unique opportunity to back a proven management team with significant skin in the game, and with a model that can be scaled by bolting on agricultural and horticultural opportunities.

Mangwana has invested in Blue Agri to fund the expansion on existing operations and new strategic opportunities.

Carolina Wilderness is an existing farming operation with over 20 years of history in the production of large-scale commercial crops. The farm is located in Harare South, bordering Lake Chivero and with access to the lake’s water. The farm is at an optimum altitude and possesses the physical, chemical and biological soil make-up which is prime for commercial cropping and citrus orchards. The farm is located in the Zvimba district (pop. 260,000).

Carolina Farm will focus on citrus, blueberry and lucerne farming. The farm is receiving support from Direct From Source Ltd – a UK based technical advisor with a strong focus on blueberry production in Zimbabwe, Zambia and Kenya. The global citrus market was valued at $5.6bn in 2019 and is projected to projected to grow at a compound annual growth rate of 4.2% from 2020 to 2027. Citrus products will be targeted at the European and Asian markets. Blueberries have become popular as a healthy and easy-to-snack fruit with strong, growing demand in Europe.

According to the CBI, Europe’s import of blueberries increased from 37,000 tonnes in 2014 to 81,000 tonnes in 2020 with further growth expected in the medium term representing a significant opportunity to increase supply to the export market. Carolina has experience growing cash crops and will add lucerne in an effort to increase positive cashflows to fund the operations of the business prior to the maturity of the citrus trees.

The company is domiciled in the UK, with intermediate holding companies established in Mauritius. Each SPC holds African SPV’s ring-fenced by project and positioned for an AIM listing. The priority minerals to be explored are nickel, cobalt, vanadium and associated minerals including copper, palladium, titanium and chrome. The company is owned and operated by a highly experienced management team with a rich history of metals exploration and trading in Zimbabwe and Southern Africa.

Mangwana Opportunites’ investment will allow AAP to take various of it’s mines to JORC Compliance status, paving the way for listing on AIM.

Investment in a gold processor with 2 milling circuits of 50,000 MT per month, in addition to proven mining claims previously drilled to JORC standards and current throughput from Artisanal miners.

As Mangwana, we are on the ground, constantly researching new opportunities for our clients and ways to create value.”

…

MANGWANA CAPITAL

Invictus Energy Ltd is an independent oil and gas exploration company focused on high impact energy resources in sub-Saharan Africa. Our asset portfolio consists of a highly prospective portion of the Cabora Bassa Basin in Zimbabwe, one of the largest under-explored interior rift basins in Africa.

SG 4571 contains the Mzarabani conventional gas-condensate prospect, the largest undrilled, seismically defined structure in onshore Africa with TCF+ potential.

Funds raised from Mangwana’s placement have been used to advance the Cabora Bassa Project including on the ground activity and preparatory works in the project area, Invictus’ CSR program within the Muzarabani and Mbire Districts and other in-country activities.

Twine and Cordage Manufacturing Company (Private) Limited (“T&C Zim”) was formed in 1948 by Ernest Ascher and Booth Smith.

T&C Zim beneficiates locally grown cotton into twine products across all sectors for sale locally and regionally. The company’s competitive advantage lies in it being able to spin their own yarn and limited reliance on imported raw material.

The naturals products include the following: